Last week the Federal Reserve cut the policy rate by 25 basis points. Rate cuts make headlines, but multifamily values are shaped by quieter forces.

If you follow the market, you’ve probably seen plenty of commentary about easier Fed policy and what it might do for real estate pricing. The simple story is that cheaper money should push values higher. The fuller story is more complex.

To see the full picture, we need to unpack a few components that drive values:

Returns and Required Premiums

For most investors, the 10-Year Treasury is the benchmark for “safe” money. If Treasuries are paying 4% and a multifamily investment is projected to deliver a 6% annual return, investors see a 2% premium for taking on the extra property risk. That feels fair, and values hold steady.

Now, if Treasuries fall to 3%, but investors insist on still earning 6% from multifamily, values don’t move higher. In order for valuations to rise, investors need to accept a smaller premium when safe alternatives are paying less. So, if Treasuries are 3%, multifamily investors should adjust their return expectations down to say 4.5 or 5%. This does not mean investors are giving up money; it means the market is re-pricing risk in a way that lifts valuations and ultimately supports stronger exit potential.

Cap Rates Explained

A cap rate is simply the property’s annual income (NOI) divided by its price. Think of it as the yield you would earn if you bought the property with cash.

For example, a $10M property that produces $600,000 of NOI has a 6% cap rate. This is the straightforward, mathematical definition.

But there’s also the idea of a market cap rate. This isn’t just about one property’s math. It’s the average return buyers and sellers across a market are agreeing on for similar types of assets. You can think of it as the “going rate” for that class of real estate in that market.

So how is the market cap rate determined?

- Transaction data. Brokers, appraisers, and research firms track recent sales of comparable properties. They calculate each deal’s cap rate (NOI ÷ Price) and then average the results to see where the market is trending.

- Appraisals and broker input. Appraisers use both transaction evidence and judgment when valuing properties for loans or deals. Brokers publish quarterly research that reflects where cap rates are actually trading.

- Investor sentiment. Market cap rates rise or fall based on how aggressive or cautious investors feel. If confidence is high, buyers bid prices up, compressing cap rates. If uncertainty rises, they bid less, and cap rates expand.

- Anchoring to Treasuries. Many investors frame cap rates as a spread over the 10-Year Treasury. If Treasuries yield 3% and investors want a 250 basis point premium, the market cap rate would land around 5.5%.

In short: a property’s cap rate is its own math. A market cap rate is a consensus number built from real transactions, appraisals, and investor expectations. Both are ways of comparing multifamily income to “safe” returns like Treasuries.

Why Fed Cuts Don’t Lower Existing Debt

When the Fed announces a rate cut, it’s easy to assume all borrowing costs instantly go down. But for properties that already have loans in place, that’s not the case.

Most multifamily loans are fixed for a set term, or floating but hedged with an interest rate cap. That means the terms were locked in when the loan originated. A Fed cut won’t automatically change the interest rate or monthly payment on that debt.

Even for floating-rate loans, the impact can be muted. Borrowers often purchase rate caps that set a maximum interest rate, but those caps don’t guarantee a lower rate when the Fed cuts. Instead, the loan still resets based on market benchmarks like SOFR, plus the lender’s spread. If the spread stays wide, the “all-in” rate may not fall much, or at all.

It’s also important to remember that the Federal funds rate is not the same as the lending rate. The Fed sets the overnight rate that banks charge each other, not the rate at which banks lend to commercial borrowers. Lenders decide their own rates and spreads based on credit risk, liquidity, and their balance sheet priorities. So even if the Fed lowers rates, lenders don’t have to pass those cuts through to borrowers.

That said, Fed cuts can create room for lenders to reduce rates if they want to stimulate more transactions, compete for high-quality borrowers, or put capital to work. For example, when liquidity is strong and credit losses are low, lenders may narrow spreads to attract deals, which allows borrowers to feel the benefit of a Fed cut more directly.

In short, Fed cuts affect new debt more than old debt. Existing loans continue on their original terms, while new buyers or refinancers may benefit from cheaper money, provided lenders choose to pass savings along and don’t tighten other requirements like leverage or DSCR.

For passive investors, this means you shouldn’t assume that a Fed cut will suddenly improve cash flow on properties you already own. The real impact shows up when debt is refinanced or when new acquisitions are underwritten with updated rates.

How It All Comes Together

We’ve covered a lot: returns and premiums, cap rates, and the limits of what a Fed cut can do for existing debt. All of these pieces matter because multifamily values aren’t set by policy alone.

Values shift based on how three things move together:

- What investors require as a return, compared to “safe” alternatives like Treasuries.

- What lenders are willing to offer, not just in interest rates, but in spreads, leverage, and terms.

- How resilient property income is, meaning whether NOI holds up or improves through the cycle.

A Fed cut can influence all three, but it doesn’t guarantee improvement in any of them. That’s why the impact on property values is rarely straightforward.

Here’s how those forces play out when we put real numbers to the equation:

4 Scenarios That Show the Math

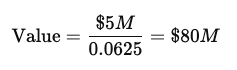

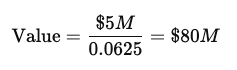

Let’s take one property earning $5M of NOI. At a market cap rate of 6.25%, the property is valued at $80M.

Now let’s see what happens under different situations after a Fed cut:

- Case 1. Fed cuts, but market cap rates don’t change

Short rates fall, yet the 10Y is flat and lenders keep spreads firm. Investors still want a 6.25%.

Result: value stays $80M. A lower policy rate did not change the asset’s valuation.

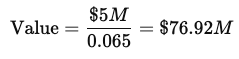

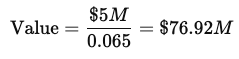

- Case 2. Fed cuts, but risk concerns drive cap rates higher

The Fed lowers short-term rates, but investors focus on slowing rent growth and rising vacancy risk. To feel protected, they demand a higher return. In practice, that pushes the market cap rate up from 6.25% to 6.50%.

Result: value falls to about $76.9M, even though the Fed cut rates.

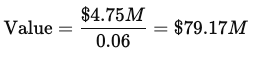

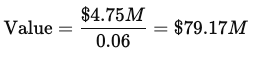

- Case 3. Fed cuts, cap rates edge down, NOI softens

The 10-Year drifts lower and the market cap rate compresses to 6.00%, but NOI slips 5% due to softening rents and lower occupancy dropping from $5M to $4.75M.

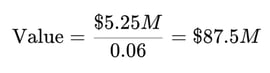

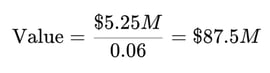

- Case 4. Fed cuts, market cap rates edge down, NOI improves

The 10-Year drifts lower and the market cap rate compresses to 6.00%. At the same time, NOI grows 5% to $5.25M.

Result: value increases to about $87.5M. Lower required returns combined with stronger income drive real appreciation. Short term pain paves the path to bigger gains.

What if the Fed Doesn’t Cut Rates Again?

For current multifamily investments, the answer is simpler than it seems: in the short term, it doesn’t really matter.

- Existing debt stays the same. Most loans are fixed or already hedged. A Fed cut doesn’t reduce those payments, and no cut doesn’t raise them either.

- Cap rates follow confidence, not the Fed. Investor return expectations and market sentiment, not policy rates, drive whether values compress or expand.

- Income is the true hinge. Stable or growing NOI will support valuations with or without a Fed cut. Weak income will drag values down even in a lower-rate environment.

Where the Fed’s decision does matter is in the refinancing cycle. The multifamily industry faces a looming wall of debt coming due in the next 12–24 months. Owners will be forced to refinance or extend existing loans, and that’s where policy decisions filter through more directly.

- If the Fed doesn’t cut: Refinancing costs stay higher for longer. Owners may face tougher DSCR hurdles, lower leverage, and wider lender spreads. That means lower loan proceeds, cash-in refinances, or in some cases distressed sales if values can’t support the debt load.

- If the Fed cuts: Borrowing costs may ease somewhat, but the benefit depends on lenders. If they choose to pass savings through by narrowing spreads or loosening terms, refinancing becomes more workable. If they stay conservative, the relief will be minimal and proceeds won’t expand much.

For passive investors, the takeaway is clear: Fed cuts are not the cure. The real difference-makers will be property income, market supply-demand dynamics, and lender behavior at refinance. Strong NOI and disciplined debt structures can weather maturities regardless of the Fed’s path. Weak income or aggressive leverage will remain exposed, even if policy shifts in a friendlier direction.

Final Thoughts

Fed cuts may grab headlines, but they aren’t the lever that determines multifamily values. For passive investors, the edge isn’t in guessing the next Fed move; it’s in aligning with sponsors who underwrite conservatively, manage income carefully, and know how to navigate capital markets.

Multifamily has always been about steady demand, durable income, and long-term value creation. Those fundamentals remain intact. Policy may shift, but disciplined execution will continue to reward investors who stay the course.

The bottom line is the Fed cuts can be a tailwind, but they are not the foundation of wealth. Multifamily’s strength lies in income resilience, thoughtful leverage, and patient capital. That’s where our confidence rests.

---

About Ellie Perlman

Ellie Perlman is the founder and CEO of Blue Lake Capital, a woman owned multifamily real estate investment firm focused on partnering with family offices and accredited investors to build and preserve generational wealth. Since its founding in 2017, Blue Lake has successfully acquired and operated multifamily assets across high-growth U.S. markets, completing $1B+ in transactions.

At Blue Lake Capital, Ellie and her team work exclusively with family offices and accredited investors, offering carefully curated investment opportunities that emphasize long-term wealth creation, stability, and risk-adjusted returns. A defining aspect of Blue Lake’s investment strategy is its integration of advanced AI-driven analytics and data science into the entire lifecycle of acquisitions and asset management. By leveraging cutting-edge technology, the firm executes data-driven forecasting on market trends, asset performance, and tenant behavior, ensuring strategic decision-making and optimized returns.

In addition to leading Blue Lake Capital, Ellie is the original founder and host of "REady2Scale - Real Estate Investing" podcast, which provides insights into multifamily real estate, alternative investments, and finance.

Ellie began her career as a commercial real estate attorney, structuring and negotiating complex transactions for one of Israel’s leading development firms. She later transitioned into property management, overseeing over $100M in assets for Israel’s largest energy company.

Ellie holds a Master’s in Law from Bar-Ilan University in Israel and an MBA from MIT Sloan School of Management.

You can learn more about Blue Lake Capital and Ellie Perlman at www.bluelake-capital.com.

*The content provided on this website, including all downloadable resources, is for informational purposes only and should not be interpreted as financial advice. Furthermore, this material does not constitute an offer to sell or a solicitation of an offer to buy any securities.