Institutional.

Disciplined.

Repeatable.

Institutional multifamily investment platform with a realized track record and a repeatable execution framework.

Proven value creation across core U.S. Sunbelt multifamily, stewarding capital for institutional and family office partners.

Platform

Overview

30%

IRR NET TO INVESTORS

1.67x

EQUITY MULTIPLE

NET TO INVESTORS

33%

AAR NET TO INVESTORS

150+

COMBINED YEARS OF EXPERIENCE

Blue Lake Capital is an institutional multifamily investment platform focused on acquiring and operating stabilized, cash-flowing assets in high-growth U.S. Sunbelt markets.

The firm is founder-led and minority woman-owned, operating with institutional governance, disciplined risk controls, and long-term capital alignment.

Our Platform Advantage

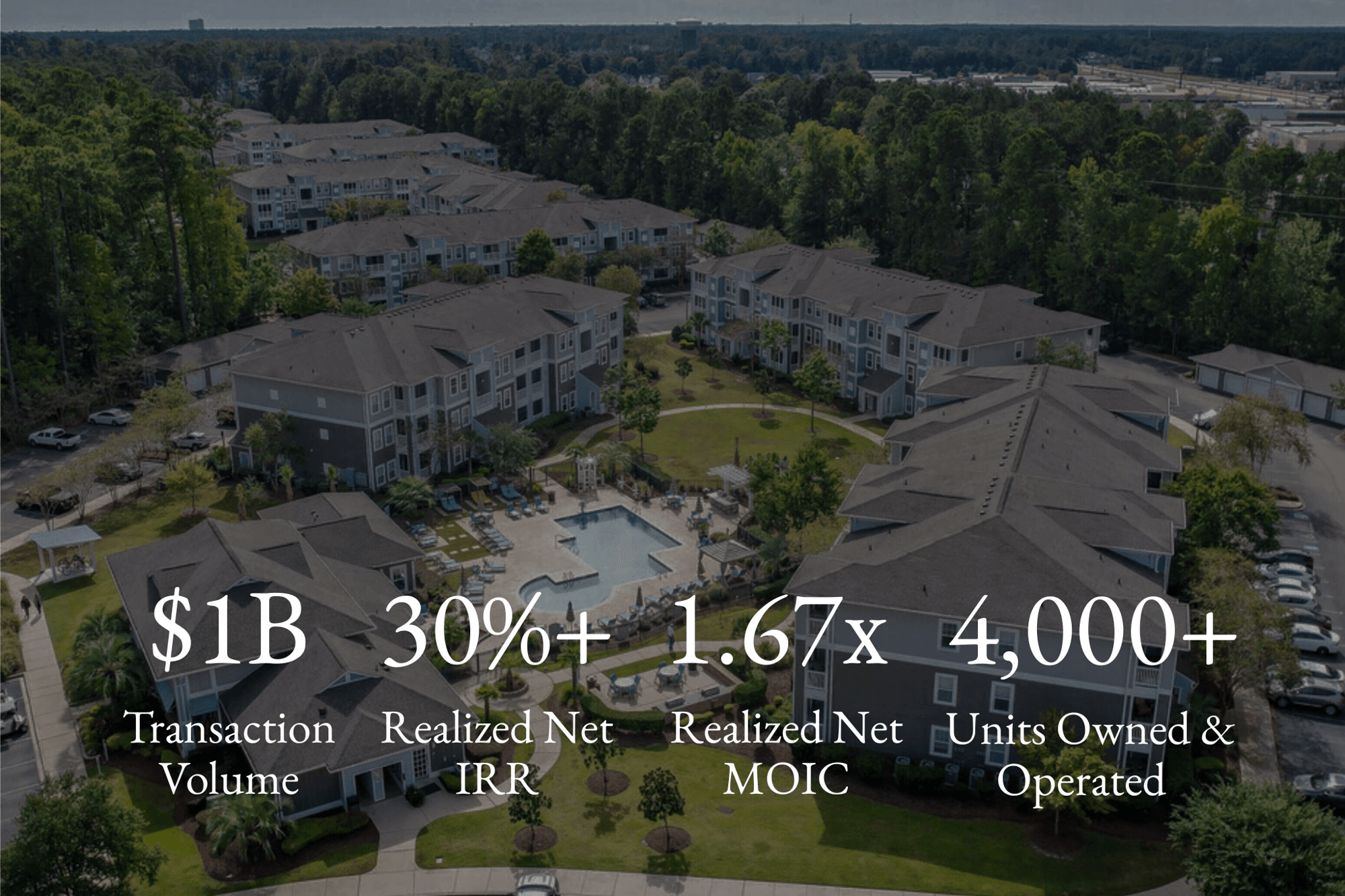

Blue Lake Capital is a minority woman-owned multifamily investment manager focused on high-growth U.S. Sunbelt markets. Since 2017, we have executed nearly $1B in multifamily transactions and evolved from an operator into an institutional-grade platform with unified systems across acquisitions, asset management, construction procurement, compliance, and investor operations.

We deliver repeatable performance through governance discipline, data-driven decisions, and operational control.

30%

IRR NET TO INVESTORS

1.67x

EQUITY MULTIPLE

NET TO INVESTORS

33%

AAR NET TO INVESTORS

150+

COMBINED YEARS OF EXPERIENCE

Our Investment

PHILOSOPHY

Discipline. Downside Protection. Long-term Stewardship.

Blue Lake focuses on acquiring well-located, cash-flowing multifamily communities in high-growth Sunbelt markets. Our philosophy centers on disciplined underwriting, conservative structuring, and a commitment to protecting investor capital across cycles.

Discipline. Downside Protection. Long-term Stewardship.

Blue Lake focuses on acquiring well-located, cash-flowing multifamily communities in high-growth Sunbelt markets. Our philosophy centers on disciplined underwriting, conservative structuring, and a commitment to protecting investor capital across cycles.

PLATFORM

PHILOSOPHY

Our Investment Focus

We acquire and operate cash-flowing, suburban multifamily communities in high-growth Sunbelt markets, focusing on durable demand, stable performance, and long-term value creation.

Governance

Investment decisions are governed by a formal investment committee process and institutional reporting standards, including regular asset-level financial reporting.

Discipline

Capital is deployed only when underwriting and committee thresholds are satisfied; no exceptions.

STEWARDSHIP

We safeguard partner capital as our own and allocate only where preservation and responsible growth can be achieved.

CAPITAL

PARTNERSHIPS

InstItutional Investors

Commingled funds and separate accounts structured for institutional governance and transparency.

Family Offices

Flexible structures designed for long-term capital and principal alignment.

Strategic JV Partners

Programmatic operating partnerships with aligned economics and repeatable execution.

Selective Access

for Aligned

Capital

Exclusive opportunities for aligned investors in resilient Sunbelt multifamily.

By invitation only.