Real estate investing is not about instant wins. It is about compounding rent, strategic financing, and understanding that time in the market usually beats timing the market. That mindset is one reason why many members of TIGER 21, a peer group of ultra-high-net-worth individuals, entrepreneurs, and family office principals, continue to allocate the largest portion of their wealth to real estate.

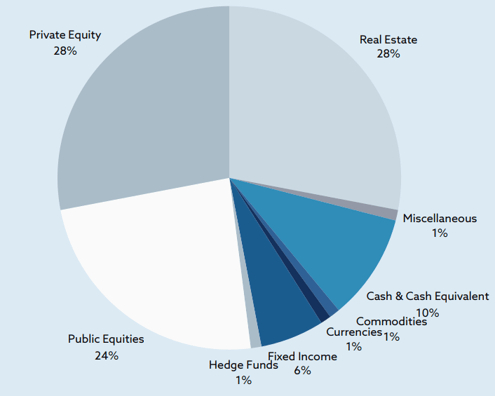

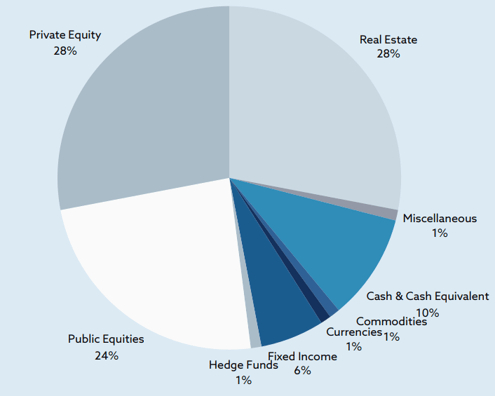

In the latest TIGER 21 Asset Allocation Report for Q1 2025, real estate makes up 28% of the average portfolio, tied with private equity. This share is ahead of public equities at 24% and well above cash holdings at 10%.

What the Latest Numbers Reveal

|

Asset class

|

Q1 2025 weight

|

Change since Q1 2024

|

|

Real estate

|

28%

|

up 2 pp

|

|

Private equity

|

28%

|

down 1 pp

|

|

Public equities

|

24%

|

up 3 pp

|

|

Cash and equivalents

|

10%

|

down 1 pp

|

|

Fixed income

|

6%

|

down 2 pp

|

|

Hedge funds

|

1%

|

down 1 pp

|

Real estate and private equity have shared the top allocation for two consecutive quarters. At the same time, hedge fund exposure has fallen to just 1%, and fixed income allocations continue to shrink. Despite market volatility and shifting asset preferences, real estate remains a durable cornerstone for long-term portfolios.

Five Insights Any Investor Can Apply

• Skill Compounds Just Like Capital

Many TIGER 21 members made their early fortunes in construction, development, or asset-heavy operating businesses. By staying close to that expertise, they are able to underwrite risk with greater clarity than spreadsheets alone can provide.

• Inflation Can Work in Your Favor

Unlike many traditional investments, real estate income often adjusts with inflation. Whether through annual lease renewals, dynamic pricing in storage or hospitality, or rent escalations in industrial assets, real estate can protect purchasing power even when other yields lag.

• Collateral Unlocks Smarter Leverage

Tangible assets give lenders security. That typically results in better loan terms. Long-term debt backed by real property often comes with more flexibility and more favorable rates than unsecured alternatives.

• Control Can Add Return

Through direct or club deals, investors have more say over financing structure, capex priorities, and hold periods. While real estate is less liquid than equities, that control can be used strategically to create value that index-based investments cannot capture.

• Built-In Estate Planning Advantages

Real estate often receives a step-up in basis at inheritance. This eliminates capital gains for heirs. Combined with stable income and potential depreciation benefits, this makes it a powerful tool for multigenerational wealth transfer.

Final Thoughts

Even as these investors shift allocations in public markets or alternative strategies, real estate consistently holds its place. It typically never falls below the mid-twenties as a percentage of the overall portfolio. Real estate remains the ballast that steadies long-term performance while offering the potential to compound quietly over time.

You do not need a TIGER 21 badge or a nine-figure balance sheet to follow the same roadmap. Start with one well-chosen asset. Use leverage wisely. Reinvest distributions and keep liquidity available for your next deliberate move. Whether your portfolio includes five units or five hundred, the habits that support wealth at the highest levels, such as patience, stewardship, and a long-term mindset, apply at every stage.

Those who already hold extraordinary wealth continue to trust real estate to preserve and grow what they have built. For those still climbing, that is a signal worth noting. Property continues to reward those who think in decades, not days.

---

About Ellie Perlman

Ellie Perlman is the founder and CEO of Blue Lake Capital, a woman owned multifamily real estate investment firm focused on partnering with family offices and accredited investors to build and preserve generational wealth. Since its founding in 2017, Blue Lake has successfully acquired and operated multifamily assets across high-growth U.S. markets, completing $1B+ in transactions.

At Blue Lake Capital, Ellie and her team work exclusively with family offices and accredited investors, offering carefully curated investment opportunities that emphasize long-term wealth creation, stability, and risk-adjusted returns. A defining aspect of Blue Lake’s investment strategy is its integration of advanced AI-driven analytics and data science into the entire lifecycle of acquisitions and asset management. By leveraging cutting-edge technology, the firm executes data-driven forecasting on market trends, asset performance, and tenant behavior, ensuring strategic decision-making and optimized returns.

In addition to leading Blue Lake Capital, Ellie is the original founder and host of "REady2Scale - Real Estate Investing" podcast, which provides insights into multifamily real estate, alternative investments, and finance.

Ellie began her career as a commercial real estate attorney, structuring and negotiating complex transactions for one of Israel’s leading development firms. She later transitioned into property management, overseeing over $100M in assets for Israel’s largest energy company.

Ellie holds a Master’s in Law from Bar-Ilan University in Israel and an MBA from MIT Sloan School of Management.

You can learn more about Blue Lake Capital and Ellie Perlman at www.bluelake-capital.com.

*The content provided on this website, including all downloadable resources, is for informational purposes only and should not be interpreted as financial advice. Furthermore, this material does not constitute an offer to sell or a solicitation of an offer to buy any securities.

-4.png?width=900&name=newsletter%20(2)-4.png)