It’s a question more investors are starting to ask - out loud, in emails, and on calls: Can you recession-proof a multifamily portfolio that...

Blog

Where we break down smart investing strategies to help you build lasting wealth...

How We’re Navigating Tariff Uncertainty & Staying Focused on Fundamentals

We’ve been talking about tariffs for months now, internally, with investors, and with our operating partners. Everyone felt the pressure bui...

How to Maximize Your K-1s (and Avoid Common Mistakes) as a Passive Real Estate Investor

If you're like many passive investors we work with, you’ve probably received a K-1 before and thought, Am I doing enough to make the most of...

2024's Top 7 Multifamily Trends: What Every Investor Needs to Know

As we look ahead to 2024, the multifamily real estate scene is buzzing with change and opportunity. I'm here to give you the inside scoop on...

Where We Are in the Multifamily Market Cycle?

Mark Twain once said that history doesn't repeat itself, but it often rhymes. This idea is really relevant in the world of real estate inves...

Stocks Vs. Real Estate. What Should I Invest In?

When it comes to growing your money and achieving financial security, deciding between investing in real estate or the stock market can be q...

Do Major Employers Move Markets? A Look at Return-to-Office and Multifamily Investing

As passive multifamily investors, understanding market trends and drivers is crucial for making informed decisions. One significant factor w...

January’s Jobs Report Highlight: Hello Renters!

As a multifamily investor, I am very pleased with the results of January’s Jobs Report. The US economy added a healthy 353,000 jobs last mon...

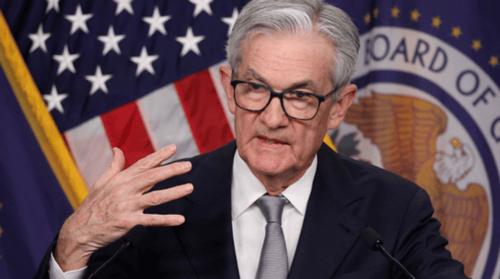

Fed's 2024 Guide: Strategic Insights for Multifamily Investors

As 2024 unfolds, let's dive into a hot topic for multifamily investors – the Federal Reserve's economic strategy. This isn't just about broa...