If you’ve been watching the multifamily market, you know last year was challenging. With new construction flooding the market, capital calls abounding, and rising costs creating pressure on investments, it was a grinding year of uncertainty. Today, that story has shifted dramatically, creating new reasons for optimism and a collective sigh of relief among passive multifamily investors.

Here are the four shifts:

1. Supply Has Tightened Significantly

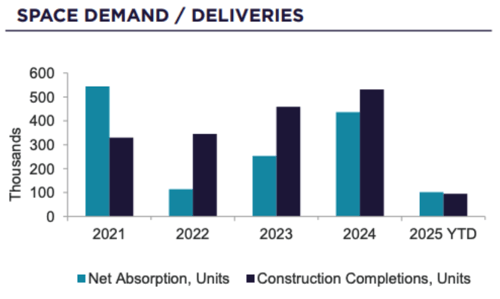

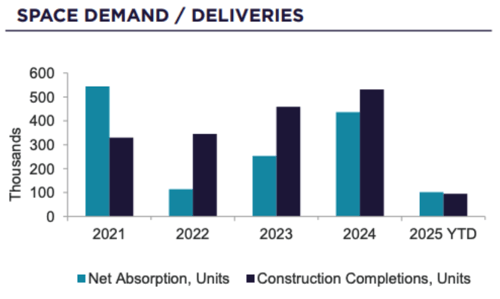

Earlier this year marked an important shift: demand outpaced new supply for the first time since 2021. In the first quarter, developers delivered 95,000 units, but tenants leased 102,000 units. This change immediately reduced vacancies and started easing concessions, shifting the conversation from filling vacancies to raising rents sustainably.

2. New Construction Is Slowing Down

Not only did demand outpace supply in a single quarter, but the construction pipeline has also significantly contracted. Currently, around 545,000 units are under construction, marking the lowest level since 2018 and nearly half the volume compared to two years ago. Factors contributing to this slowdown include:

- Rising construction costs due to tariffs increasing budgets by approximately 3% to 4%.

- High borrowing costs, with average fixed mortgage rates near 6.76%, causing developers to pause or cancel projects.

Fewer new projects starting today mean reduced competition for existing multifamily assets tomorrow.

3. Rents Are Gaining Momentum

With fewer units coming to market, rents are stabilizing and even beginning to increase again. National rents saw modest increases of about $5 per month in March and April, with occupancy holding firm at around 94.5% since January. Markets such as New York City, Columbus, Chicago, and Kansas City are already seeing annual rent growth between 3% and nearly 6%, signaling stability and gradual improvement.

4. Investor Confidence is Growing

Investors are noticing this positive shift. According to a recent Berkadia poll, 83% of respondents plan to acquire multifamily assets this year. Property values remain 15% to 20% below their 2021 peaks, while recent transactions in early 2025 have shown modest cap rate compression, indicating investors' growing confidence that rental income will outpace borrowing costs.

What Does This Mean for Investors?

Final Thoughts

Today’s multifamily market presents strong opportunity, one shaped by tightening supply, steady demand, and improving financial conditions. Passive investors have a chance to leverage these positive shifts and position themselves strategically for both stability and growth. Rather than navigating uncertainty, the path ahead now offers clarity, making 2025 an ideal year to strengthen or diversify your multifamily investment portfolio. As market conditions continue to tilt in favor of current and prospective multifamily investors, staying informed and proactive will be key to capturing the benefits of this favorable environment.

---

About Ellie Perlman

.png?width=900&name=newsletter%20(1).png)

.png?width=900&name=newsletter%20(4).png)