Real estate is not a lottery ticket. It is a strategy built on consistency, discipline, and time. After two challenging years, the Emerging Trends in Real Estate 2025 report offers a quiet but steady signal: the tide is turning. The data and commentary reveal a growing sense of cautious optimism. This time, it is not fueled by hype but by fundamentals.

Here is what the latest survey shows and how thoughtful investors can position themselves for the next chapter.

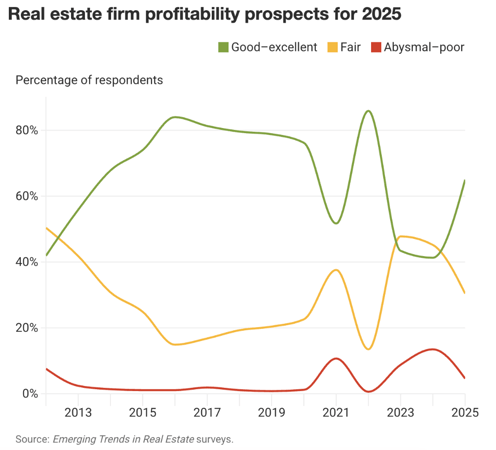

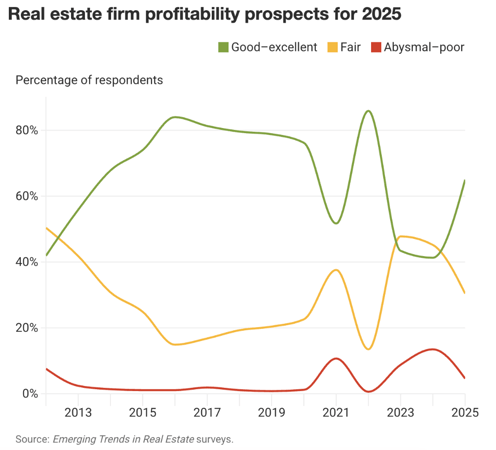

Profitability Is Rising Again

In the Emerging Trends survey, optimism about profitability has returned. 65% of respondents now expect their firm’s bottom line to be good or excellent in 2025. That is a significant increase from just 41% a year ago. Only 5% foresee poor results.

This chart tells the story. The green curve is climbing, while the yellow and red lines are fading. Lower debt costs, more active deal-making, and clearer pricing are setting the stage for healthier margins in the months ahead.

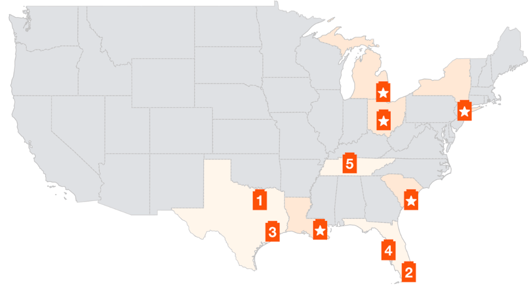

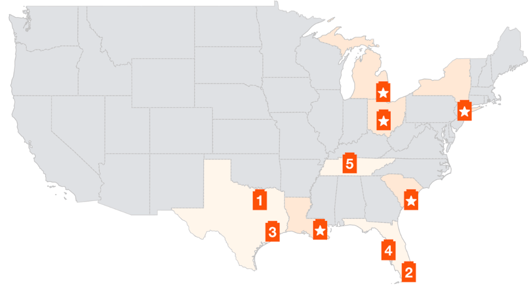

Top Markets to Watch

Confidence is not spread evenly across the map. The survey highlights 10 markets that stand out as ones to watch in 2025:

- Dallas-Fort Worth

- Miami

- Houston

- Tampa-St. Petersburg

- Nashville

- Orlando

- Atlanta

- Boston

- Salt Lake City

- Phoenix

Each of these metros offers a mix of strong job growth, population inflow, and manageable new supply. Many are classic Sun Belt cities. However, Boston and Salt Lake City show that innovation-driven economies outside that footprint still have a compelling story.

Note for investors: While these markets rank high on survey optimism, some such as Florida metros, may pose challenges for multifamily due to rising insurance costs. It is important to balance enthusiasm with underwriting discipline.

Five Reasons the Outlook Is Improving

1. Rate Relief Is Reshaping the Landscape

When the Federal Reserve delivered its first 50-basis-point cut late last summer, the mood shifted. Since then, borrowing costs have steadily declined. 80% of industry leaders surveyed now believe mortgage rates will continue to ease through 2025. Lower rates mean lower holding costs and better acquisition math. For those who have been waiting on the sidelines, now may be the time to start moving.

2. Liquidity and Confidence Are Returning

The bid-ask gap is narrowing. Cap rates are stabilizing. Deals are no longer stuck in a holding pattern. A Chicago-based multifamily sponsor captured the mood well: “We are no longer guessing where the bottom is.” Pension funds, private equity firms, and family offices are re-entering the market with renewed allocations. Combined with more favorable debt terms, capital is flowing again.

3. Demand Never Really Left

Even during the rate shocks of 2023 and early 2024, occupancy held steady across many property types. Job growth continued, consumer spending remained strong, and immigration supported new household formation. The rise of hybrid and remote work added another layer. More than 35 million Americans migrated to “surban” communities that offer walkability, amenities, and a lifestyle blend. The need for space never disappeared. It just paused, waiting for financing to catch up.

4. Certain Sectors Are Leading the Way

- Rental Housing: Structural undersupply remains the dominant theme. While some Sun Belt markets work through temporary oversupply, the national picture shows a persistent gap in affordable and workforce housing. As rates decline, both deal volume and renovation activity are expected to pick up.

- Data Centers: AI training and cloud services require immense energy and infrastructure. Primary data center hubs are essentially full, pushing rents higher and encouraging new development in secondary markets.

- Industrial Warehousing: E-commerce growth and reshoring continue to fuel demand. Modern facilities with the right specs and labor pools remain scarce. Tenants are locking in longer leases and paying premium rates.

5. Disciplined Strategies Will Win

The days of easy money and speculative flips are fading. Today’s environment rewards operators who prioritize income, use leverage prudently, and build long-term value. 66% of survey respondents expect “good” or “excellent” profits in 2025. However, they are not aiming for sharp spikes. They are planning for steady, measured gains. For investors, that is not just comforting; it is sustainable.

Final Thoughts

Real estate is transitioning out of reset mode and into the early stages of recovery. Lower rates, increased liquidity, resilient demand, and clear sector narratives all point to opportunity ahead.

The rewards will not come overnight. They rarely do. But they will favor those who stayed engaged during the downturn, made thoughtful decisions, and aligned with managers who know how to balance caution with conviction.

If you are reading this, you probably did the hard part already. You stayed the course. Now it is time to lean in, look forward, and take the next step with strategy and confidence.

---

About Ellie Perlman

Ellie Perlman is the founder and CEO of Blue Lake Capital, a woman owned multifamily real estate investment firm focused on partnering with family offices and accredited investors to build and preserve generational wealth. Since its founding in 2017, Blue Lake has successfully acquired and operated multifamily assets across high-growth U.S. markets, completing $1B+ in transactions.

At Blue Lake Capital, Ellie and her team work exclusively with family offices and accredited investors, offering carefully curated investment opportunities that emphasize long-term wealth creation, stability, and risk-adjusted returns. A defining aspect of Blue Lake’s investment strategy is its integration of advanced AI-driven analytics and data science into the entire lifecycle of acquisitions and asset management. By leveraging cutting-edge technology, the firm executes data-driven forecasting on market trends, asset performance, and tenant behavior, ensuring strategic decision-making and optimized returns.

In addition to leading Blue Lake Capital, Ellie is the original founder and host of "REady2Scale - Real Estate Investing" podcast, which provides insights into multifamily real estate, alternative investments, and finance.

Ellie began her career as a commercial real estate attorney, structuring and negotiating complex transactions for one of Israel’s leading development firms. She later transitioned into property management, overseeing over $100M in assets for Israel’s largest energy company.

Ellie holds a Master’s in Law from Bar-Ilan University in Israel and an MBA from MIT Sloan School of Management.

You can learn more about Blue Lake Capital and Ellie Perlman at www.bluelake-capital.com.

*The content provided on this website, including all downloadable resources, is for informational purposes only and should not be interpreted as financial advice. Furthermore, this material does not constitute an offer to sell or a solicitation of an offer to buy any securities.