Understanding AI's Profound Impact on Commercial Real Estate

AI is revolutionizing three critical areas of commercial real estate:

1. Enhanced Decision-Making

AI analytics empower faster, more accurate data-driven decisions about markets, investments, acquisitions, and overarching strategy.

- Predictive Modeling: By analyzing demographics, employment trends, transportation plans, and other historical and projected data, AI can forecast future supply/demand, pricing, and investment returns in different markets. This enables investors to refine their acquisition and development strategies.

- Automated Valuation Models (AVMs): AVMs can instantly estimate property values by analyzing comparable sales, rents, operating expenses, capitalization rates, and other financial metrics. This is not only faster but also more cost-effective than traditional manual appraisals.

Interested in a deeper dive?

Listen to our podcast episode How AI Creates a Competitive Edge for Investors

2. Enhanced Tenant Experiences

AI equips landlords to offer personalized, flexible, tech-driven experiences that resonate with modern renters.

- Virtual Tours: Prospective renters can remotely explore units and amenities at their convenience. This not only increases engagement but also accelerates leasing. Did You Know? Properties offering virtual tours witnessed a 30% increase in leasing velocity during the pandemic.

- Hyper-Personalized Marketing: By harnessing individual browsing data, behaviors, and preferences, AI crafts bespoke promotions, recommendations, and communications for each prospect.

- Smart Home Tech: Mobile app-based controls for lighting, climate, security, and more offer unmatched convenience, making properties more appealing.

3. Improved Operational Efficiency

AI's automation capabilities streamline workflows, reduce costs, and elevate tenant satisfaction.

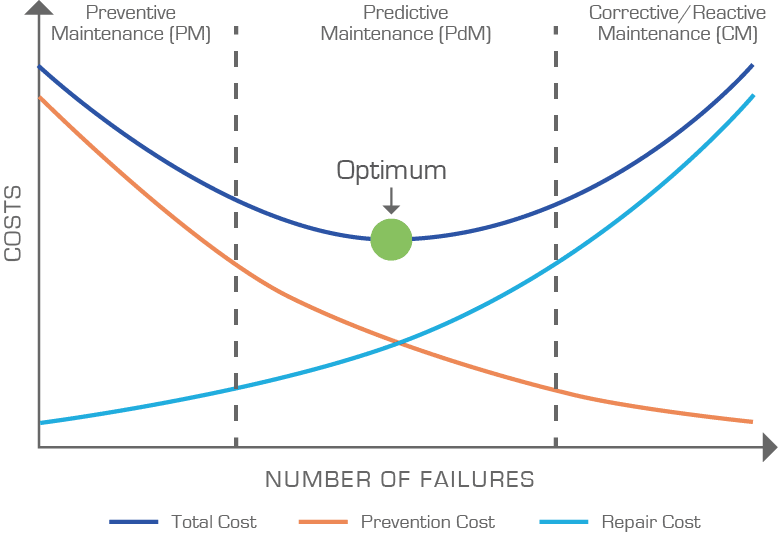

- Predictive Maintenance: By analyzing sensor data and past work orders, AI can optimize maintenance schedules, preventing equipment failures and minimizing downtime.

- Chatbots & Virtual Assistants: These AI-driven tools manage routine tenant queries 24/7, allowing leasing staff to focus on more complex tasks.

- Revenue Management Algorithms: Borrowed from the travel industry, these algorithms adjust pricing and availability in real-time, maximizing rental income. Early adopters have reported rental rate increases of up to 15%.

Addressing AI Concerns in Real Estate

While AI offers immense potential, it's essential to address common concerns:

- Data Privacy: Ensuring tenant and investor data is protected is paramount. AI-driven systems must adhere to stringent data protection regulations.

- Job Displacement: While AI can automate tasks, the human touch remains irreplaceable in areas like investor relations and strategic planning. The goal is to use AI to complement, not replace, human roles.

8 Key Takeaways for Passive Real Estate Investors

-

AI's Transformative Role: Artificial intelligence (AI) is becoming a major disruptive force in commercial real estate, especially in multifamily housing. Its integration can lead to significant opportunities and challenges.

-

Data-Driven Decision Making: AI analytics, such as predictive modeling and automated valuation models, enable faster and more accurate decisions about markets, investments, and acquisitions. This means more informed investment choices and potentially higher returns.

-

Enhanced Tenant Experience: AI-driven tools like virtual tours, hyper-personalized marketing, and smart home technology can attract modern renters more effectively. Properties that offer these features may see increased demand and higher rental rates.

-

Operational Efficiency: AI can streamline property management processes, from predictive maintenance to chatbots handling tenant queries. This can lead to reduced operating costs and improved tenant satisfaction, both of which can positively impact the bottom line.

-

Revenue Optimization: AI algorithms can adjust rental pricing in real-time based on various factors, ensuring that properties are always priced optimally to maximize rental income.

-

Industry Evolution: The real estate sector, traditionally slow to adopt technology, is undergoing rapid innovation due to AI. Early adopters stand to gain a competitive advantage, while those who lag may find themselves at a disadvantage.

-

Concerns to Address: While AI offers many benefits, concerns like data privacy and potential job displacement need to be considered and addressed.

-

Blue Lake Capital's AI Integration: For passive investors looking for a tech-driven investment approach, Blue Lake Capital uses AI to identify promising multifamily investment opportunities, aiming to reduce risks and maximize returns.

Final Thoughts

Companies that strategically harness AI now will reap the benefits of enhanced insights, efficiency, and tenant experiences. However, those that delay risk being overshadowed in an evolving industry landscape.

Real estate, historically slow in tech adoption due to its fragmented nature, is now at the cusp of rapid innovation. AI presents both monumental opportunities and challenges.

Forward-thinking investors and operators must cultivate AI capabilities now to stay ahead and prepare for the impending revolution. The horizon is promising for those who champion innovation.

As always, be sure to consult with your financial advisor and do your own due diligence before joining into any investment.

---

About Ellie Perlman

At Blue Lake Capital, Ellie and her team work exclusively with family offices and accredited investors, offering carefully curated investment opportunities that emphasize long-term wealth creation, stability, and risk-adjusted returns. A defining aspect of Blue Lake’s investment strategy is its integration of advanced AI-driven analytics and data science into the entire lifecycle of acquisitions and asset management. By leveraging cutting-edge technology, the firm executes data-driven forecasting on market trends, asset performance, and tenant behavior, ensuring strategic decision-making and optimized returns.

In addition to leading Blue Lake Capital, Ellie is the original founder and host of "REady2Scale - Real Estate Investing" podcast, which provides insights into multifamily real estate, alternative investments, and finance.

Ellie began her career as a commercial real estate attorney, structuring and negotiating complex transactions for one of Israel’s leading development firms. She later transitioned into property management, overseeing over $100M in assets for Israel’s largest energy company.

Ellie holds a Master’s in Law from Bar-Ilan University in Israel and an MBA from MIT Sloan School of Management.

You can learn more about Blue Lake Capital and Ellie Perlman at www.bluelake-capital.com.